As a contractor, navigating through the complexities of various projects is no easy feat. Each endeavor comes with its own set of risks and uncertainties that can potentially pose a threat to the success of your business. This is where the power of contractor insurance comes into play, providing a formidable shield to safeguard your projects from potential financial pitfalls.

Among the various types of contractor insurance available, workers comp insurance is an essential component that shouldn’t be overlooked. This coverage ensures that your employees are protected in the event of any work-related injuries or illnesses, providing them with necessary medical treatment, disability benefits, and even compensation for lost wages. By prioritizing the safety and well-being of your workers, you not only create a positive work environment but also mitigate the risk of expensive legal battles and financial burden.

Another crucial aspect of contractor insurance is home insurance. When embarking on projects that involve working in client’s homes, it’s vital to have the appropriate coverage in place. Home insurance shields you from potential third-party claims due to property damage or accidents caused during the course of your work. From accidental spills to unintentional damage to expensive furnishings, having home insurance gives you the peace of mind to focus on delivering impeccable workmanship.

General liability insurance is yet another valuable element of contractor insurance. This coverage acts as a safety net, protecting your business from legal liabilities arising from accidents or property damage caused to third parties. Whether it’s a slip and fall incident at a construction site or inadvertently damaging a neighboring property while working on a project, this insurance shields you from the burdensome costs that could potentially cripple your business.

By comprehensively understanding and availing yourself of the power of contractor insurance, you can shield your projects from unforeseen circumstances and concentrate on the growth and success of your business. Don’t underestimate the importance of investing in workers comp insurance, home insurance, and general liability insurance. These measures provide the necessary protection and peace of mind, unlocking your potential for greater accomplishments within the contracting industry.

Understanding Contractor Insurance

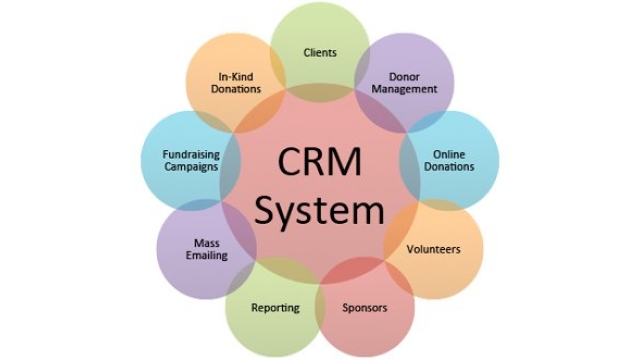

Contractor insurance is a vital aspect of any construction project, offering valuable protection to both contractors and clients. It encompasses various types of insurance, such as workers’ comp insurance, home insurance, general liability insurance, and contractor insurance itself. Understanding these different coverages and their significance is crucial for ensuring the successful completion of your projects.

Workers’ comp insurance provides coverage for work-related injuries or illnesses that may occur to employees on the job. This insurance not only safeguards workers’ well-being but also protects contractors from potential legal liability arising from workplace accidents. By having workers’ comp insurance in place, contractors can rest assured that medical expenses and lost wages of their employees will be taken care of, allowing projects to proceed smoothly.

Home insurance is another key component of contractor insurance. It safeguards clients’ properties during the construction process, providing coverage against potential damage or loss. With home insurance, homeowners can feel secure knowing that any unforeseen events, such as property damage due to accidents or natural disasters, are covered. For contractors, having home insurance helps build trust with clients by ensuring that they are protected against potential liabilities resulting from their construction activities.

General liability insurance offers protection in the event of third-party claims for bodily injury or property damage caused by the contractor’s operations. Accidents can happen, and the costs associated with legal claims and settlements can be significant. However, by having general liability insurance, contractors can mitigate these risks, as the insurance policy will cover the expenses resulting from such claims. This coverage not only safeguards contractors’ financial interests but also boosts their credibility and reputation in the industry.

Contractor insurance overall plays a critical role in shielding projects against potential risks and liabilities. By understanding the various types of contractor insurance, contractors can ensure they have adequate coverage for their projects, protecting both themselves and their clients from any unexpected events that may arise during the construction process.

The Importance of Workers Comp Insurance

When it comes to protecting your projects and ensuring the safety of your workers, Workers Comp Insurance stands as a vital shield. This type of insurance not only safeguards your employees but also shields your business from potential liability claims and financial setbacks.

Accidents can happen unexpectedly, even in the most controlled environments. Whether it’s a slip-and-fall incident or an injury caused by equipment malfunction, workers face various risks on the job. Workers Comp Insurance provides the necessary support and coverage to ensure that injured workers receive proper medical treatment and compensation for their lost wages. By obtaining this insurance, you create a safety net for your employees, demonstrating your commitment to their well-being.

Furthermore, Workers Comp Insurance acts as a powerful buffer against potential legal troubles. Without this coverage, your business may be exposed to lawsuits from employees who sustain work-related injuries or illnesses. In such cases, the financial strain of legal fees, settlements, and damages can significantly impact your business’s stability. Workers Comp Insurance helps shield your projects and your bottom line by covering these expenses, allowing you to focus on what matters most: the successful execution of your projects.

In summary, investing in Workers Comp Insurance provides both immediate and long-term benefits for your business. It not only protects your employees by ensuring access to medical care and compensation but also safeguards your business from potential lawsuits and financial burdens. By prioritizing the safety and well-being of your workers, you establish a foundation of trust and security that contributes to the overall success of your projects.

Protecting Your Projects with General Liability Insurance

Contractor Insurance Colorado

When it comes to safeguarding your projects, General Liability Insurance plays a vital role. This comprehensive insurance coverage provides protection against a range of risks and liabilities that may arise during your contracting work. With General Liability Insurance, you can ensure that your projects are shielded from potential financial losses.

One of the key areas covered by General Liability Insurance is bodily injury. Accidents can happen unexpectedly, and if a third party sustains bodily harm on your project site, this insurance coverage can protect you from potential lawsuits and legal expenses. Whether it’s an injured worker or a visitor to your site, having General Liability Insurance can provide the necessary coverage to handle such situations.

Additionally, General Liability Insurance also covers property damage. Construction projects can be complex, involving various tools, equipment, and materials. In the event that any of these items cause damage to someone else’s property, this insurance coverage can help cover the costs of repairs or replacements. This ensures that your projects are not only protected but also that you can mitigate any potential financial liabilities.

Furthermore, General Liability Insurance can safeguard you against claims of advertising or personal injury. If anyone accuses you of copyright infringement, slander, or defamation in the course of your contracting work, this insurance coverage can assist in covering legal expenses and settlements. By having the proper insurance in place, you can focus on your projects with peace of mind, knowing you have protection against unforeseen circumstances.

In conclusion, General Liability Insurance is a crucial component of contractor insurance. It offers a range of coverage that safeguards your projects from potential risks, liability claims, and financial losses. With its protection against bodily injury, property damage, and claims of personal injury, General Liability Insurance acts as a shield for your projects, allowing you to focus on your work and ensuring a successful outcome.